Oil & Gas

Fueling Sinoswiss Holdings’ Growth and Investor Returns

Sinoswiss Holdings has established a strong presence in the oil and gas sector, making it a significant source of income, investment, and investor security. Here’s how our oil and gas ventures contribute to our success and investor confidence:

Lucrative Revenue Stream:

Oil and gas are vital commodities powering global industries. By strategically exploring, extracting, and selling oil and gas resources, Sinoswiss Holdings generates substantial revenue. This income allows us to fund operations, invest in further exploration and development, and deliver returns to our investors.

Long-Term Investment Potential:

Oil and gas remain in high demand, making them lucrative long-term investments. Sinoswiss Holdings strategically invests in oil and gas reserves, ensuring a steady flow of income and the potential for significant capital gains when we sell assets in the future. This translates to long-term financial security for our investors.

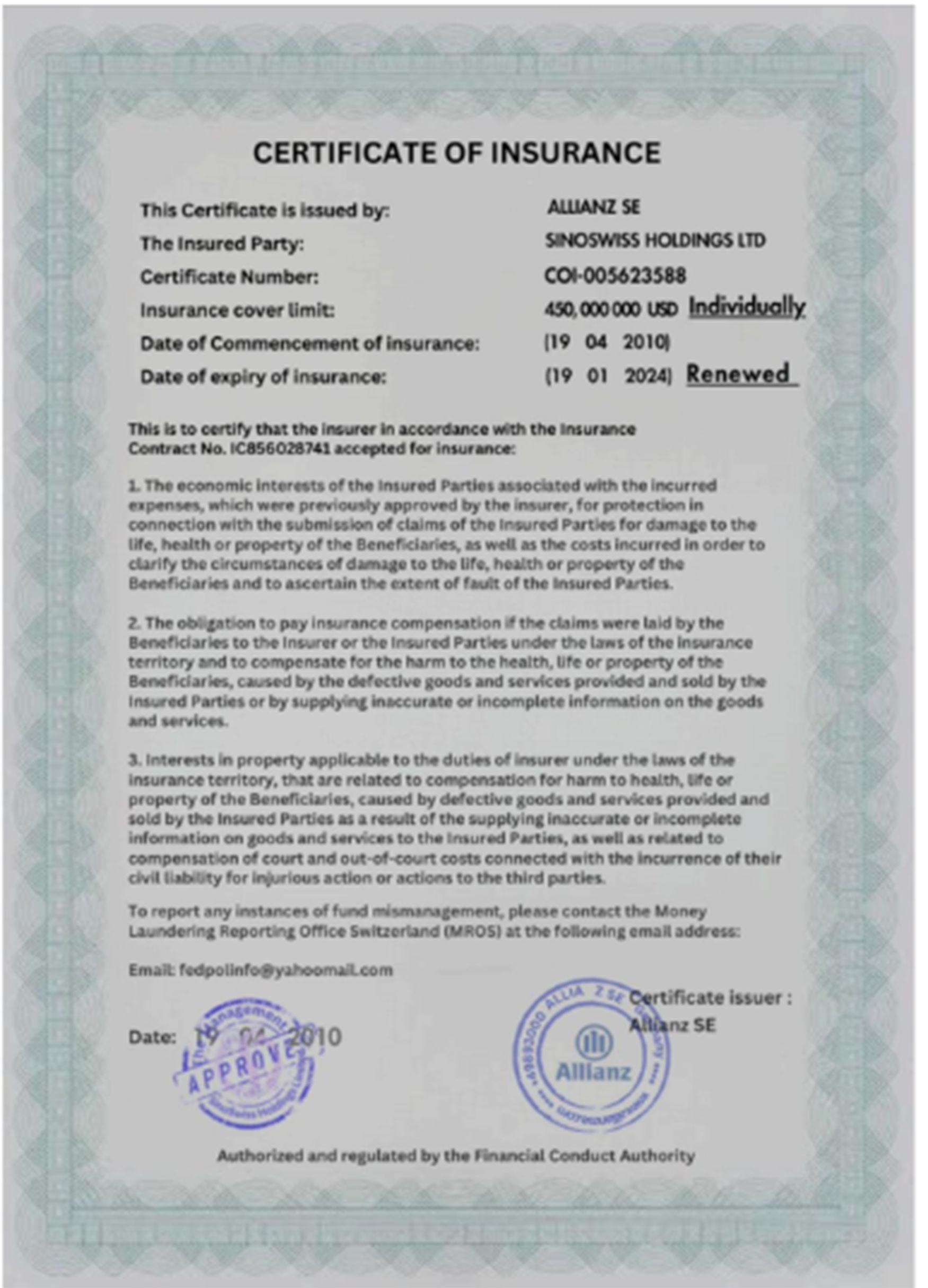

Risk Mitigation Strategies:

We understand the inherent volatility of the oil and gas market. To safeguard our investors, Sinoswiss Holdings implements risk mitigation strategies, such as geographic diversification of our resources and hedging techniques. This proactive approach helps ensure consistent returns despite market fluctuations.

By actively participating in the oil and gas sector, Sinoswiss Holdings secures a stable income stream, fosters long-term growth, and safeguards our investors’ assets.